Saturday, October 25, 2008

Attack on Greenspan: Original Email

watching Alan Greenspan appear and testify in front of the Congress

oversight committee in the last few days.

This is who we trusted with the money supply and ridiculously low

interest rates that led to horrible lending practices, investments,

and "keeping the financial system stable".

The federal reserve is a joke. Don't regulate the markets, regulate

the FED, or get rid of it all together and reform.

Here is the famous bubble maker at his finest. This is his response to

why we are in the mess we are in. :

http://www.youtube.com/watch?v=XkQumR6Poag

I'd bet a significant amount of money that Ben Bernanke will be in the

same position years from now after this bailout package and the low

interest rates we have now create another bubble.

Andrew Alanis

The World is Flat: In Response to Attack on Greenspan

The World is Flat

By Robert Dotras

Andrew, you are dead wrong, and your statement is so far in left field that I actually cannot believe that people are saying this; these attacks on Greenspan are perpetuated by the drive by media and are completely baseless. The function of the Fed is complicated and cannot be explained properly in a few short sentences. In the following essay I will attempt to explain in detail the complexities of the macroeconomy and some of the effects of interest rates.

The abstract of this essay is firstly to address the purpose of a target Fed Funds rate, secondly I will address inflation and the byproducts of interest rates, and lastly I will address specific concerns about home prices and the housing bubble.

You stated: “This is who we trusted with the money supply and ridiculously low interest rates that led to horrible lending practices, investments,

and "keeping the financial system stable…I'd bet a significant amount of money that Ben Bernanke will be in the same position years from now after this bailout package and the low interest rates we have now create another bubble.”

Those ridiculously low interest rates is how Greenspan handled and controlled the markets post 9/11. Lower interest rates get you out of a recession. In order to keep the economy moving, people borrowing and spending, lower rates were what was needed, as always when there are fears of recession, (Graph 1) the lower interest rates unfreeze the banking system and allowed people to borrow. Bank to bank borrowing is in essence a way for banks to quickly raise needed capital. An example would be the following: Say a major industrial corporation like Ford wanted to borrow money from a bank to build a new plant in Norfolk VA, if the bank did not have the amount of capital needed to finance the project in reserve, then they would need to get it from somewhere namely another bank. In this case the bank will quickly raise this amount from other banks at an interest rate equal to or higher than the Federal funds rate. When you have a low rate the bank can offer a more attractive interest rate therefore you will more than likely want to borrow the money needed to spur economic growth. Which was badly needed post 9/11.

Graph 1: Historical Fed Funds Rate

I do not see the correlation between being able to borrow more freely and “horrible lending practices and investments”. You are equating that just because money flows for a lesser price that would automatically mean that it is being wasted or used in an improper way. Here is the fundamental flaw with this argument, the Fed did not force anyone to borrow at a low interest rate, just because the money is being lent at an attractive rate does not mean you have to borrow and banks always need to self regulate who they lend money to, or else they go out of business, so in the effort of self preservation, banks should and need to be very conservative in who they lend money to. The ones that fail to adhere to this policy go out of business. Now here is the “Catch-22” we have incentivized the risk, a prime example is the FDIC Insurance and full faith backing of mortgages by the government for mortgages issued by Fannie Mae and Freddie Mac. Greenspan was not referring to any fundamental flaw with the system, but a flaw in the irrationality of people. Greenspan said he was “shocked” to realize that banks would not protect themselves and the equity of their shareholders and disregard risk management in favor of carelessness. The fundamental flaw is irrationality, non-self preservation, not a flaw of the system or with the Federal Reserve.

You stated: “Here is the famous bubble maker at his finest. This is his response to why we are in the mess we are in.”

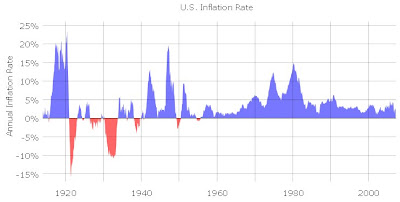

Here you refer to Greenspan as a “bubble maker”. By blaming Greenspan who had nothing to do with Countrywide Financial giving NINJA (No Income, No Job, No Assets) loans to people that could not afford the terms. The terms being an ARM or Adjustable Rate Mortgage taking out a loan of this type is insane and I have no idea why anyone would do it. But, in this country you are allowed to make bad decision all on your own. This is partly what was driving the prices of homes up. All Greenspan is guilty of is spurring the economy and preventing a post 9/11 recession all while keeping inflation at record lows. (See chart 2) Inflation is a natural by product of more money being injected into the economy, being an inflation hawk, I think Greenspan did an excellent job throughout his entire tenure as Chairman of the Federal Reserve (1987-2006) in keeping inflation low.

Chart 2: Historical US Inflation

One should always take advantage of low interest rates and borrow when rates fall, this spurs the economy with the purchase of homes, autos, and even things like student loans are affected. However, low interest rates are NOT the cause of falling home prices now.

Home prices are definitely lower however according to the Office of Federal Housing Oversight prices have only fallen 5.9% nationwide since last year (Chart 3)

Chart 3: Historical Home Prices In The United States

What might surprise you is this, according to the same organization home prices in the Pacific region have fallen more than 19%, greatly outpacing the national average. Why is this you might ask, the reason is simple, the price were too high to begin with. There was obviously too much demand and not enough supply at the time, and a huge massive correction fixed that. I am not going to cry for someone in San Francisco who paid $800,000 for a 2 bedroom flat, and now realizes that there home is now only worth $648,000.

The housing craze of the late 90’s and early 00’s is what is to blame, I blame this bubble on television shows like TLC’s “Flip This House” where someone buys a “fixer upper house” and turns around and sells it for 10’s of thousands of dollars more than they paid. Well this created lots of demand and drove prices up and now the housing markets are correcting themselves. Not to mention government programs that force banks to lend money to low income peoples, namely the Community Reinvestment Act. This is taken directly from the Federal Financial Institutions Examination Counsel website “The Community Reinvestment Act is intended to encourage depository institutions to help meet the credit needs of the communities in which they operate.” The purpose of this piece of legislation is to force banks to make loans accessible to everyone even those who probably should not be buying a house in the first place.

In conclusion, what Greenspan was talking about when he said that there was a fundamental flaw in the system was the fact that people were doing irrational things, they were not calculating and measuring risk properly (risky subprime loans). The Federal Reserve does not need more regulations, more government regulation is what got us into this mess in the first place. He assumed that it would not be in your best interest to invest in a complicated structured product namely Collateralized Mortgage Obligations that would ultimately fail when the mortgages that they were representing failed. When those products were heavily invested in and did fail it was not exactly what you would do in an effort of self preservation. Furthermore Alan Greenspan was an excellent Chairman of the Federal Reserve and it is completely ridiculous to blame him for the situation we are in right now.